Bitcoin (BTC) is trading with a bullish bias, driven by renewed optimism surrounding US–China trade negotiations and signs of détente between Donald Trump and Elon Musk, two of the world’s most powerful men.

The momentum shift in geopolitical and social dynamics helped push global markets higher. While Chinese stocks in Hong Kong enter a bull market and the S&P 500 approaches its February highs, Bitcoin may be poised for a new all-time high (ATH).

Trade Diplomacy Reignites Risk Appetite

BeInCrypto data shows Bitcoin surged nearly 4% in the last 24 hours and was approaching the $110,000 threshold. As of this writing, BTC was trading for $109,275, steadily approaching its $111,814 ATH recorded on May 22, 2025.

The surge follows a high-level trade discussion between the US and China, which resumed on Monday, June 9, at London’s historic Lancaster House.

“I am pleased to announce that Secretary of the Treasury Scott Bessent, Secretary of Commerce Howard Lutnick, and United States Trade Representative, Ambassador Jamieson Greer, will be meeting in London on Monday, June 9, 2025, with Representatives of China, with reference to the Trade Deal. The meeting should go very well,” Trump said in a Truth Social post on June 6.

According to a Bloomberg report, the meeting stretched more than six hours and will continue into Tuesday, June 10.

Treasury Secretary Scott Bessent leads the US delegation alongside Commerce Secretary Howard Lutnick and US Trade Representative Jamieson Greer. They attempt to strike a deal with China’s Vice Premier He Lifeng over technology export controls and rare earth shipments.

Expectations are that the US may ease export restrictions on chip design software and advanced materials. In return, they would get increased access to China’s rare earth supply.

The Trump administration remains firm on protecting high-end semiconductor technologies like Nvidia’s H2O AI chips. However, Reuters reported that officials hinted at a broader willingness to compromise.

Bitcoin’s strong recovery highlights its increasing sensitivity to global macro winds. Controversial trader James Wynn anticipated market optimism in a June 6 post on X (Twitter).

“Once this trade deal is cleared up, another green light for crypto to start rallying,” Wynn wrote in a Friday post.

Trump–Musk Feud Cools, Fueling Crypto Greed

Another boost to Bitcoin sentiment likely stems from an unexpected détente between Elon Musk and Donald Trump, after their online feud roiled crypto markets, causing nearly $1 billion in liquidations.

The richest man in the world and the most powerful man appear to be extending olive branches.

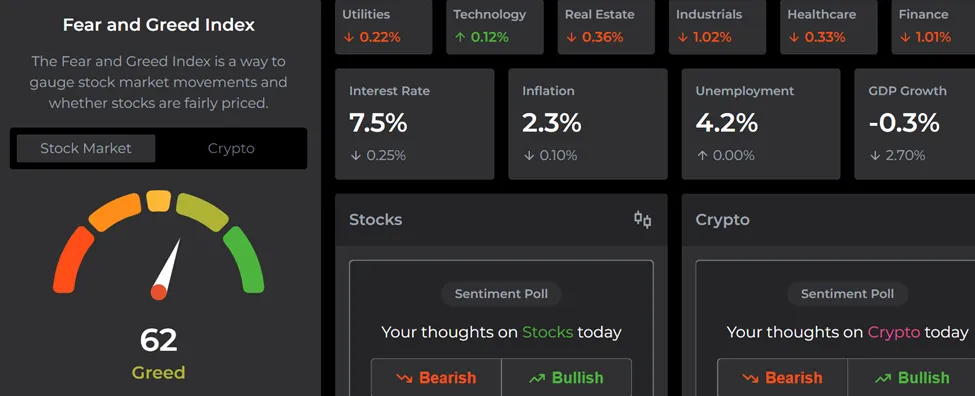

The softening of Musk and Trump’s hostilities coincides with a sharp shift in investor mood. Bitcoin’s rebound pushed the Crypto Fear & Greed Index into “Greed” territory. The change in sentiment came as traders interpreted the Musk–Trump rapport as a stabilizing force amid broader volatility.

Nevertheless, speculation is that the conflict may have been engineered or orchestrated.

“The Trump-Musk Feud: A Staged Manipulation… They’re orchestrating the drop – but not joining in themselves… The abrupt emergence of the Musk-Trump clash is not accidental… Collaboratively, they unsettle retail, paving the way for fresh market surges,” wrote DeFi researcher Qmo.

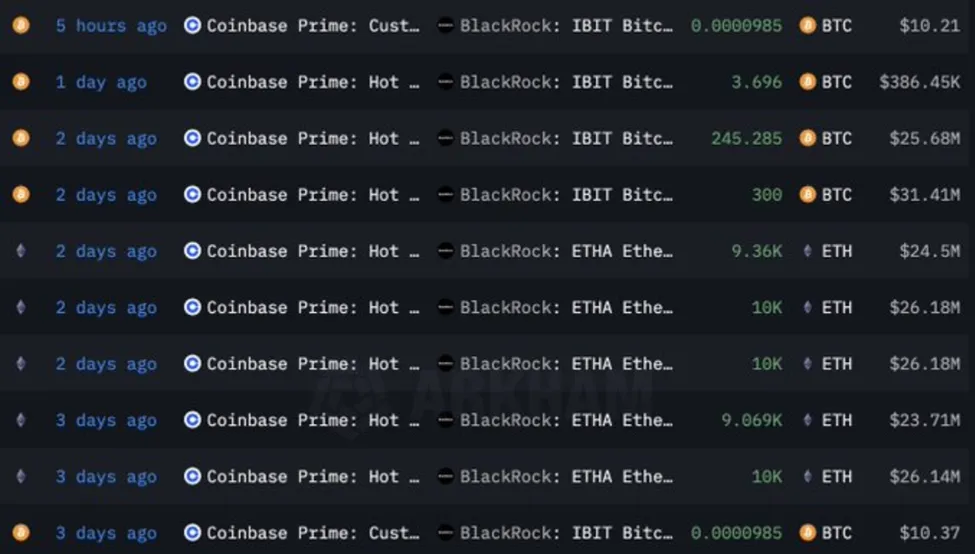

Blockchain data supports the claim, showing large BTC accumulations by whale wallets during the feud’s peak.

Bitcoin’s recovery highlights how tightly the crypto market is tethered to high-level diplomacy and narratives surrounding influential actors like Trump and Musk.

With talks between the US and China set to continue today, and Musk’s perceived realignment with Trump, traders are watching for confirmation of de-escalation and potential policy clarity.

At the time of writing, Bitcoin is trading at $109,406, with altcoins also beginning to move. CoinGecko data shows Ethereum is up by over 7% in the last 24 hours, while Solana (SOL) and Dogecoin (DOGE) surged by over 5%.

If Tuesday’s session in London yields concrete progress, Bitcoin could rally further, potentially establishing a new all-time high, especially with altseason narratives gaining traction.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Be the first to comment